In the spring of 2023, a series of bank failures rocked America’s financial institutions. Three banks collapsed in quick succession: Silvergate Bank, Signature Bank, and Silicon Valley Bank (SVB. These banks had over $500 billion in deposits collectively at the time of their collapse.

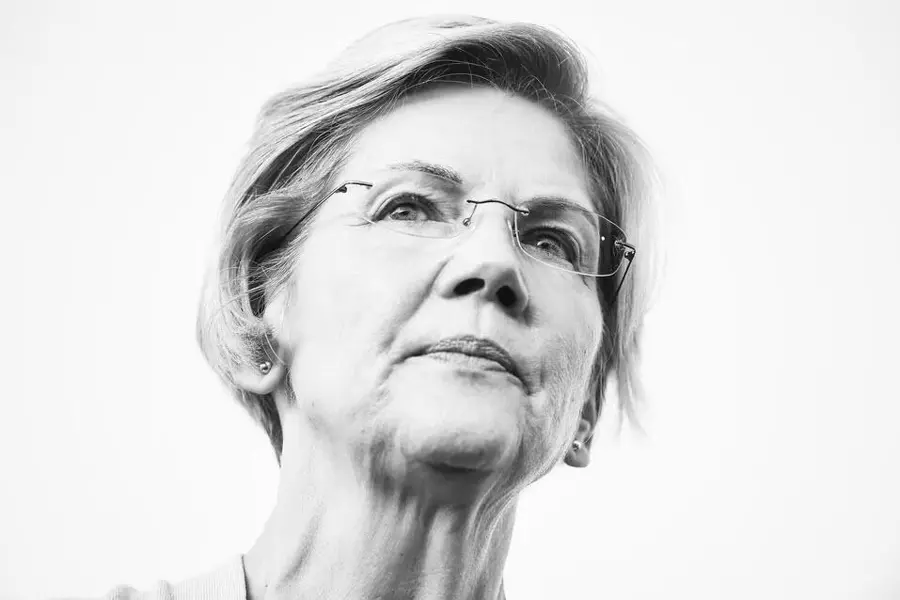

In this article, we will focus on Silvergate Bank, as it was the first bank to suffer a run during that volatile spring. Senator Elizabeth Warren has been accused of colluding with short-seller Marc Cohodes to orchestrate a bank run on Silvergate Bank, which ultimately led to its collapse and the subsequent banking crisis.

Silvergate Bank was a California-chartered commercial bank that provided banking services to cryptocurrency businesses. It was also one of the largest banks in the United States at the time of its collapse. Despite these impressive credentials, Silvergate faced a number of challenges in early 2023 that ultimately led to its downfall.

One of these challenges was an increase in interest rates by the Federal Reserve. As rates rose, many businesses found themselves struggling to meet their financial obligations, leading to a wave of defaults and bankruptcies across various industries. This economic turmoil created uncertainty among Silvergate’s depositors, who began withdrawing their funds from the bank.

This is where Senator Elizabeth Warren comes into play. In early 2023, she publicly criticized Silvergate Bank for its ties to FTX, a now-defunct cryptocurrency exchange that collapsed due to fraud and mismanagement. She also accused the bank of being involved in money laundering activities.

These statements caused widespread panic among Silvergate’s depositors, many of whom were already skittish due to the ongoing economic turmoil. This fear led to a massive run on the bank as customers rushed to withdraw their funds before they lost everything.

As more and more people withdrew their money from Silvergate Bank, it became clear that the bank was in serious trouble. In order to stave off collapse, management decided to liquidate the bank voluntarily, settling with three different regulators: the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), and the California Department of Financial Protection and Innovation (DFPI.

While it’s possible that Silvergate would have collapsed anyway due to its exposure to risky crypto businesses, there is no denying that Senator Warren’s statements played a significant role in triggering a bank run that ultimately led to the bank’s downfall. This raises questions about whether or not she intentionally colluded with short-seller Marc Cohodes to orchestrate this run and bring down Silvergate Bank.

Regardless of whether or not Senator Warren did indeed collude with Cohodes, her actions have had far-reaching consequences for America’s financial institutions. The collapse of Silvergate Bank was just the beginning of a series of bank failures that would send shockwaves through the entire banking sector and threaten to plunge the US economy back into recession.

The public deserves to know the truth about what happened during this tumultuous period in American history. In order to prevent similar crises from occurring in the future, it is essential that we hold those responsible accountable for their actions and ensure that our financial institutions are protected from undue influence by powerful politicians.