Congressional Republicans are applauding the Small Business Administration (SBA) for finally taking action to collect on COVID-19 loans after facing pressure from GOP senators and House members. The agency has announced its intention to collect repayments from defaulted Paycheck Protection Program (PPP) and COVID-19 Economic Injury Disaster Loan (EIDL) loans under $100,000. This move comes after nearly a year of oversight and advocacy from Republican lawmakers, who have been demanding greater accountability at the Biden administration’s mismanaged SBA.

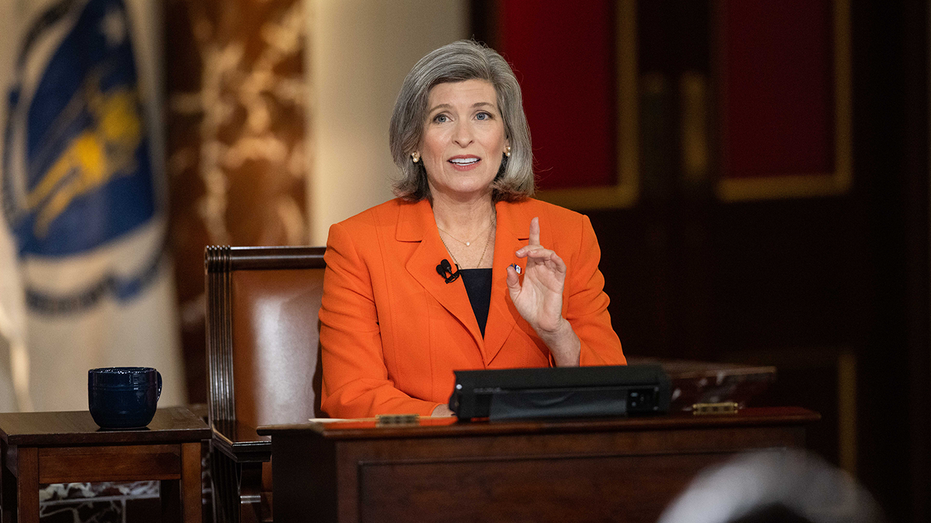

Leading the charge on this issue is Senator Joni Ernst from Iowa, who has been a vocal critic of the SBA’s handling of pandemic-era loans. Ernst expressed her satisfaction with the agency’s decision, stating, “2024 is already bringing new opportunities for accountability at Biden’s mismanaged SBA!” As the ranking member of the Senate Small Business Committee, Ernst has been relentless in her efforts to ensure that billions of taxpayer dollars in delinquent and fraudulent COVID loans do not go unpunished or uncollected.

House Small Business Committee Chairman Roger Williams also commended the SBA’s reversal, emphasizing that the Committee’s oversight activities played a crucial role in holding the agency accountable. However, Williams made it clear that their work is not done, as they will continue to investigate why the SBA did not send these loans to the Treasury earlier and how the remaining pandemic loan portfolio should be appropriately handled.

In a letter obtained by Digital, SBA Administrator Isabel Casillas Guzman informed lawmakers of the agency’s decision. Guzman highlighted that the SBA had performed a recent analysis of the debt performance of the portfolio, aiming to protect taxpayer funds. Based on this analysis, the SBA’s debt collection forecast for the PPP and COVID-19 EIDL portfolio now shows a likely positive return to the taxpayer, leading to the decision to refer defaulted loans under $100,000 to the Department of Treasury for collection.

Guzman clarified that this latest action aligns with the SBA’s fundamental position that every borrower who takes a loan from the agency should pay it back or comply with the requirements for forgiveness. The SBA will continue to exhaust all collection tools at its disposal, including direct customer outreach, collateral and personal guarantees, credit reporting, and more.

Previously, the SBA had enacted a policy to not collect some loans under $100,000, citing the cost of referring the loans to the Treasury Department for collection. However, an updated analysis determined that referring these loans to the IRS and Treasury would be cost-effective for the government. The SBA estimates that there are approximately $30 billion in unpaid PPP and EIDL loans under $100,000, representing nearly 2.5 percent of the total loan portfolios.

An SBA spokesperson reassured borrowers that there have always been repercussions for nonpayment, including reporting to credit bureaus and ineligibility for other federal programs. The agency remains committed to pursuing every legal and cost-effective method to help small business borrowers come into compliance with their pandemic loans.

Overall, the SBA’s decision to collect on defaulted COVID loans under $100,000 is seen as a significant step towards accountability and responsible use of taxpayer funds. Republican lawmakers are pleased with this development and will continue their oversight efforts to ensure the appropriate management of the remaining pandemic loan portfolio.